- Compare auto insurance rates michigan drivers#

- Compare auto insurance rates michigan driver#

- Compare auto insurance rates michigan full#

- Compare auto insurance rates michigan plus#

Compare auto insurance rates michigan drivers#

Hudsonville Michigan drivers may be curious how much car insurance costs in their state. It also helps you avoid legal complications if you're caught driving without it.

TIP: Try this site where you can compare quotes from different companiesĬar insurance is one of the most essential steps you can take to safeguard your financial future. On the other hand, insurers in Hawaii had the best loss ratio for physical damage (48.7%), along with the only loss ratio less than 50% during the period.How to Find the Best Car Insurance Cost in Hudsonville Michigan In the state, the loss ratio from 2016 to 2020 was 82.3%. Insurance providers in Wyoming had the worst collective loss ratio for physical damage compared to those in any other state. Conversely, in West Virginia, insurers had a cumulative loss ratio of 53.4% for liability, the best of any state. Insurers in the state posted an average loss ratio of 117.9% during this time period. A higher loss ratio may suggest that remaining profitable in a given state is more difficult than at a national level.įor liability coverage, loss ratios were highest from 2016 to 2020 in Michigan - by far. Loss ratios can vary by state, differing from each other and from the loss ratios recorded by the largest national insurers. The average cumulative loss ratio across all auto insurance companies from 2016 to 2020 was 68% for liability policies and 62% for physical damage. USAA's loss ratio improved the most, shrinking by 15.5 percentage points from 76.2% to 60.7%. Among the 10 largest providers, each improved its loss ratio compared to 2018.

Compare auto insurance rates michigan plus#

ValuePenguin also analyzed loss ratios - claims paid plus expenses divided by the value of written premiums - among the largest car insurance providers. New Jersey, on the other hand, has the eighth most expensive car insurance rates but ranks 29th for cost relative to income. Because of differences in household income levels, the cost of coverage can take up a larger share of income in certain states, even when premiums are relatively low.įor example, Mississippi ranks 30th for most expensive premiums by state but ninth for car insurance premiums compared to income. The average yearly cost of auto insurance takes up different amounts of drivers' incomes depending on the state they live in. For example, PIP requirements in Michigan are higher than in other states, and PIP costs $4,180 per year.

Compare auto insurance rates michigan driver#

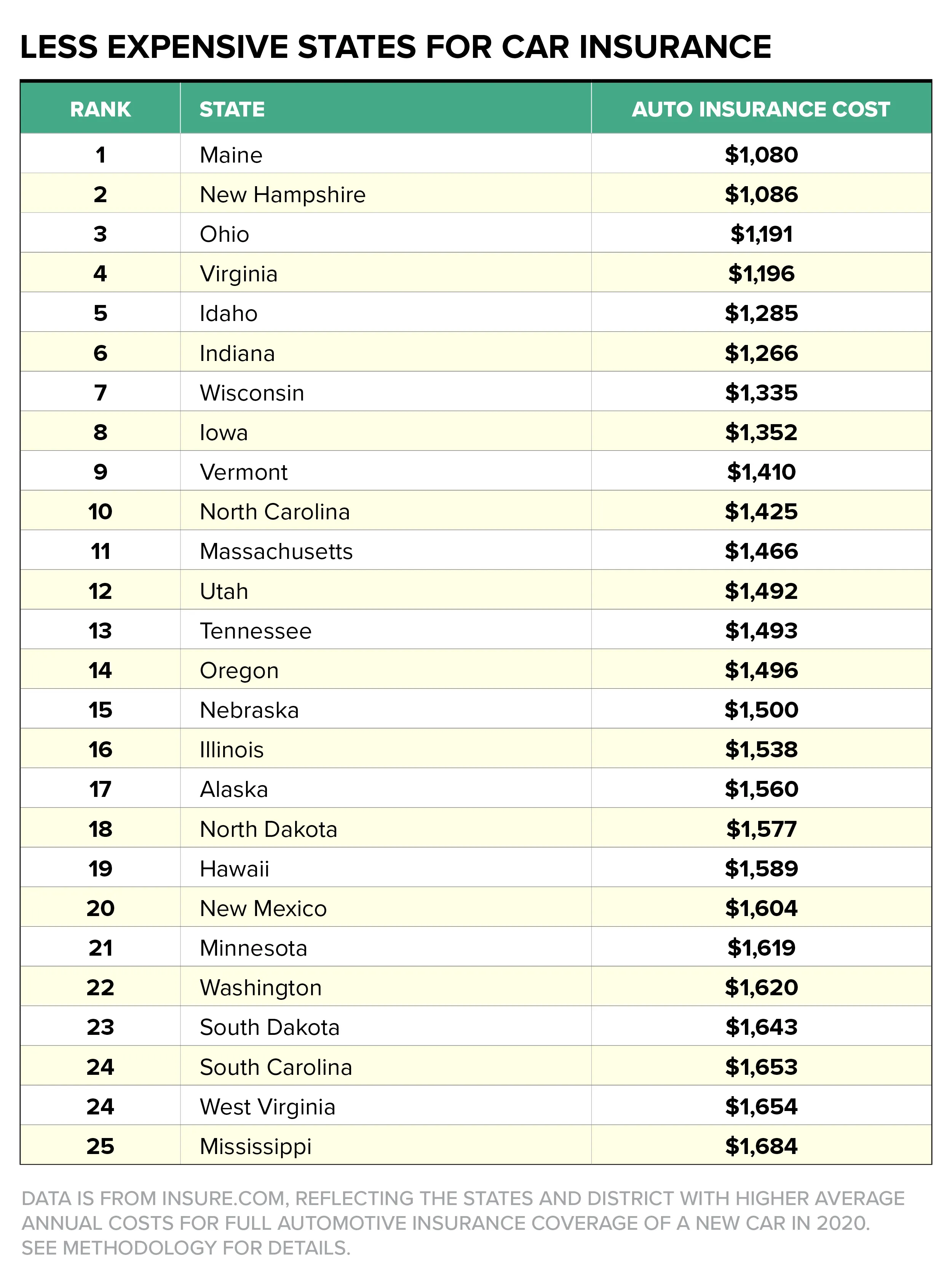

On average, the yearly PIP premium is $158 - but it can be much higher depending on where the driver lives. This protection, also called at-fault car coverage, pays for injuries that result from a crash no matter which driver was responsible for the accident. In many states, lawmakers require drivers to purchase personal injury protection (PIP). States ordered highest to lowest by cost. For instance, in Michigan, car insurance costs 254% more per year than the national average. While the average yearly car insurance payment is $2,361 across every state and the District of Columbia, the cost of coverage at the state level can vary significantly. With comprehensive coverage - which costs $363 - the premium for both forms of coverage comes to $1,252. The average cost of auto collision coverage is $889 per year.

Compare auto insurance rates michigan full#

The most expensive part of full coverage car insurance is collision protection, which insurers usually require to be purchased along with comprehensive coverage. Drivers are almost always required to buy liability coverage to drive legally.

The average cost of bodily injury liability coverage is $538 per year, and the average cost of property damage liability is $274 per year. The average yearly cost of auto insurance is $2,361, and the monthly cost is $197. Biggest car insurance companies in the US.Cost of car insurance compared to income.

0 kommentar(er)

0 kommentar(er)